hornoselectricos.online

Overview

How Much Does It Cost To Charge Tesla At Home

Home charging costs are calculated using your utility rate plan you set in the app for all charging that happens at your Home location. Supercharger. Home charging (AC) for a Tesla Model 3 · Charging type. Wall plug ( kW) · Time (empty to full). 38h 30m · Range per hour of charging. 18 km/h · Our. Every Tesla Model Y costs an average of $ to charge at home. Fully charging a Model Y at a public charging station will cost between $ and $ The. While electricity costs vary, the average price in California is about 18 cents per kilowatt hour (kWh). At this price, charging an electric car such as the. Tesla home charger installation costs can vary between $ to $, depending on the installation requirements. There are three different chargers to charge. Wall Connector is our fastest way to charge your electric vehicle, whether a Tesla or non-Tesla, at home. For homes with more than. Generally, in my case, I would estimate that regular charging at home is costing me between $40/$50 per month. We only charge when we go on. Assuming you own a Tesla Model 3 powered by a kWh battery, it would cost you anywhere between $ and $ to fully charge your Tesla overnight from your. Charging a kWh Model X battery at home, assuming the U.S. average electricity rate of $/kWh and 85% charging efficiency, costs about $ For the. Home charging costs are calculated using your utility rate plan you set in the app for all charging that happens at your Home location. Supercharger. Home charging (AC) for a Tesla Model 3 · Charging type. Wall plug ( kW) · Time (empty to full). 38h 30m · Range per hour of charging. 18 km/h · Our. Every Tesla Model Y costs an average of $ to charge at home. Fully charging a Model Y at a public charging station will cost between $ and $ The. While electricity costs vary, the average price in California is about 18 cents per kilowatt hour (kWh). At this price, charging an electric car such as the. Tesla home charger installation costs can vary between $ to $, depending on the installation requirements. There are three different chargers to charge. Wall Connector is our fastest way to charge your electric vehicle, whether a Tesla or non-Tesla, at home. For homes with more than. Generally, in my case, I would estimate that regular charging at home is costing me between $40/$50 per month. We only charge when we go on. Assuming you own a Tesla Model 3 powered by a kWh battery, it would cost you anywhere between $ and $ to fully charge your Tesla overnight from your. Charging a kWh Model X battery at home, assuming the U.S. average electricity rate of $/kWh and 85% charging efficiency, costs about $ For the.

At most Tesla Supercharging stations in the US, the rate is $ per kWh, or about double the average home rate, so around $14 or at a Supercharger, using the. On an average UK tariff, the cost to charge the Tesla Model 3 Standard Range Plus at home is approximately £ However, by switching to an EV-friendly. Wall Connector offers the fastest charging speed for your home or office, adding up to 44 miles of range per hour of charge. You can order a Wall Connector. It costs between $ and $ to fully charge a Tesla based on the national average cost of electricity. But if you're generating your own electricity, that. Generally, the electric cost of charging a Tesla depends on the car model and the size of the battery. Also, the cost of electricity per kilowatt hour (kWh) in. It's generally cheaper to charge your electric car at home than at a charging station. The average cost for home charging is 32p per kWh and 48p per kWh for a. Key takeaways · You can expect to pay between $6 and $50 to fully charge your Tesla at a Supercharger station, excluding any fees. · Superchargers have an average. Charging a Tesla Model 3 with a charge point at home with a standard Economy 7 tariff, a total of 80% of its capacity will give the vehicle around miles of. Charging a Tesla's cost depends on electricity rates, charging speed, and battery capacity. Typically, it ranges from $8 to $20 for a complete charge. Installing a new V outlet can cost $ - $1, Charging speed is up to 3 mph with a standard household outlet, or up to 30 mph with a V outlet. †. The average price per kilowatt hour (kWh) for a Supercharger in the UK is 67p, but Tesla owners who subscribe to the £ per month membership will be charged. Although often higher in California, average pricing at Tesla Superchargers is typically around $ per kWh. You can expect it to cost between $$25 to. For an EV, you will use about kWh in that time frame. Using the U.S. household average of cents per kWh, charging an electric car at home would cost. Tesla Charging: How Much Does it Cost? · Tesla Model 3 comes with a kWh battery and miles of range, and will cost about $ to be fully charged at a. How Much Does It Cost to Charge a Tesla Model 3? Pricing at Superchargers varies by location, but the cost is typically about $ per kWh. A full recharge to. Our Tesla charging cost calculator indicates that it costs anywhere between $4 and $20 to charge your Tesla electric car at home. For example, charging a Tesla. And if you charge at a third-party charging station, just pay on the spot. *See your EV Rental Terms to learn more. How do I. A Tesla Model 3 has a 50 kWh battery which means on average you will pay $7,5 to charge it to full capacity. State, Charge Cost (% Capacity). California, $9. Tesla owners can in fact charge via a standard V residential outlet with a trickle charging adapter. It's nicknamed “trickle” charging because it's really.

Why Is Lexus Oil Change So Expensive

Why is Full Synthetic Motor Oil So Expensive? What are the Benefits of Synthetic Oil Changes? More manufacturers today design their engines explicitly around. Which also means it's more expensive, but it's well worth the extra investment. The cost of an oil change can vary depending on factors such as the type of. Approximately $60 in labor, $85 in parts, $40 to 'dispose oil'. They couldn't provide a further break down. 10% off coupon if I go there on the. Well, the pricing comes from the genuine OEM parts and oil that are used to make sure your vehicle is running smoothly. Service Range Rover Sport Oil Type. What. Synthetic oil is usually more expensive than conventional oil and will cost between $45 and $ It lasts longer and is designed for high-performance. In addition, you need a filter ring for a successful Porsche oil change. Let the certified service professionals at Porsche Westlake handle your Porsche when. A professionally done Lexus oil change costs anywhere from $60 to $ Lexus oil change prices depend on the model of your vehicle, how many miles are on it. How much does it cost for oil and filter change on a Lexus RX? 2 so they need a periodic oil change. Your car's manufacturer site or your. The price varies because of several factors, such as the local cost of living rates, and the age and type of your Lexus model. To get accurate Lexus oil change. Why is Full Synthetic Motor Oil So Expensive? What are the Benefits of Synthetic Oil Changes? More manufacturers today design their engines explicitly around. Which also means it's more expensive, but it's well worth the extra investment. The cost of an oil change can vary depending on factors such as the type of. Approximately $60 in labor, $85 in parts, $40 to 'dispose oil'. They couldn't provide a further break down. 10% off coupon if I go there on the. Well, the pricing comes from the genuine OEM parts and oil that are used to make sure your vehicle is running smoothly. Service Range Rover Sport Oil Type. What. Synthetic oil is usually more expensive than conventional oil and will cost between $45 and $ It lasts longer and is designed for high-performance. In addition, you need a filter ring for a successful Porsche oil change. Let the certified service professionals at Porsche Westlake handle your Porsche when. A professionally done Lexus oil change costs anywhere from $60 to $ Lexus oil change prices depend on the model of your vehicle, how many miles are on it. How much does it cost for oil and filter change on a Lexus RX? 2 so they need a periodic oil change. Your car's manufacturer site or your. The price varies because of several factors, such as the local cost of living rates, and the age and type of your Lexus model. To get accurate Lexus oil change.

Why is Full Synthetic Motor Oil So Expensive? What are the Benefits of Synthetic Oil Changes? More manufacturers today design their engines specifically around. Why is Full Synthetic Motor Oil So Expensive? What are the Benefits of Synthetic Oil Changes? More manufacturers today design their engines specifically around. So by changing the oil, you're protecting the most important parts of the engine. HOW MUCH OIL DOES MY CAR NEED? If we had a nickel for every time someone asked. Oil breakdown is caused by heat, friction, contamination and oxidation. Today's oils and synthetics are designed to combat these elements – resulting in the. Lexus oil change costs are expensive due to specific oil and filters, the dealership experience, and skilled mechanics using leading equipment. Lexus cars. Oil Change · Brakes · Batteries · Parts Center · Order Parts · Genuine Lexus So, is Lexus maintenance expensive? The service team at Lexus of Cherry Hill. Is it time to change the oil in your Volvo car? How much is the Volvo oil change cost? Is it very expensive? How critical is it? So, how much does it cost for an oil change? The price can vary. But, it can range anywhere from $35 to $ depending on your specific vehicle. The oil will degrade over time from the constant exposure to heat, moisture, and air. The oil filter helps catch some of the debris the oil has picked up while. Lexus manufactures reliable, fuel-efficient, smooth-firing, and durable combustion engines. Optimizing long-term engine performance requires oil changes when. Why is Full Synthetic Motor Oil So Expensive? What are the Benefits of Synthetic Oil Changes? More manufacturers today design their engines definitely around. Lexus Smyrna and we will be more than delighted to help you! Why is Full Synthetic Motor Oil So Expensive? What are the Benefits of Synthetic Oil Changes? How much does a Lexus oil change cost? The amount depends on where you live, how old your vehicle is, and what type of Lexus model you have. When you schedule. Why is Full Synthetic Motor Oil So Expensive? What are the Benefits of Synthetic Oil Changes? Visit our store today or contact our service center with any. Synthetic-based, like regular synthetic and blend options, oils are more expensive, so be sure to ask about service specials to cut costs. © Lexus of. General Lexus Maintenance Costs ; Oil change, $ to $ ; New tires, $ to $1, ; 10,mile scheduled maintenance, $+ ; Spark plug replacement, $ to. Is Lexus Maintenance Expensive? Lexus Maintenance. If you're thinking about oil change costs, the benefits of OEM parts, what tire numbers mean, and. expensive damage before its time. But how much is an oil change? For most However, synthetic oil lasts longer than conventional oil so you can go. However, even the most durable Lexus models still need routine maintenance. Lexus maintenance costs will vary for every driver. Weather, road conditions. It provides the best protection around. Yet, many patrons still ask "What are the benefits of full synthetic motor oil?" and "Why is it so expensive?".

How Much Are Closing Costs When You Refinance

The good news is that you don't need to pay full price when it comes to refinancing closing costs. Key Takeaways. Borrowers should shop around if they want to. There are many fees when buying a house: land transfer tax, notary fees, inspection fees it's easy to forget something. We've created a calculator to help you. The cost to refinance a mortgage ranges from 2% to 6% of your loan amount, and you can expect to pay less to close on a refinance than on a comparable purchase. When you refinance your mortgage, expect to encounter costs similar to those from your original mortgage. They often range from approximately 2 percent to 6. They include fees such as loan origination fees, appraisal fees, survey fees, title insurance fees, taxes and others. Since mortgage loans are offered by. For example, if you're taking out a mortgage of $,, you may likely end up spending another $1,$16, on closing costs. As far as how much you can. Many first time buyers underestimate the amount they will need. Generally speaking, you'll want to budget between 3% and 4% of the purchase price of a resale. These closing costs can average between 2% and 6% of the loan amount according to hornoselectricos.online The lender you choose, the kind of mortgage you want, and your. Sometimes a lender will recoup their closing costs by increasing the interest rate. In either scenario, know that you, the homeowner, will likely not be able to. The good news is that you don't need to pay full price when it comes to refinancing closing costs. Key Takeaways. Borrowers should shop around if they want to. There are many fees when buying a house: land transfer tax, notary fees, inspection fees it's easy to forget something. We've created a calculator to help you. The cost to refinance a mortgage ranges from 2% to 6% of your loan amount, and you can expect to pay less to close on a refinance than on a comparable purchase. When you refinance your mortgage, expect to encounter costs similar to those from your original mortgage. They often range from approximately 2 percent to 6. They include fees such as loan origination fees, appraisal fees, survey fees, title insurance fees, taxes and others. Since mortgage loans are offered by. For example, if you're taking out a mortgage of $,, you may likely end up spending another $1,$16, on closing costs. As far as how much you can. Many first time buyers underestimate the amount they will need. Generally speaking, you'll want to budget between 3% and 4% of the purchase price of a resale. These closing costs can average between 2% and 6% of the loan amount according to hornoselectricos.online The lender you choose, the kind of mortgage you want, and your. Sometimes a lender will recoup their closing costs by increasing the interest rate. In either scenario, know that you, the homeowner, will likely not be able to.

Expect to pay 2% to 5% of the new mortgage amount in closing costs when you refinance your mortgage. If you have sufficient equity in your home and you're. These costs can include third-party fees, insurance, escrow and taxes. You should review your Loan Estimate and your Closing Disclosure for a complete list. For example, if you're taking out a mortgage of $,, you may likely end up spending another $1,$16, on closing costs. As far as how much you can. Estimating how much you'll owe on closing costs is important if you're trying to determine whether a mortgage refinance is even worth it. Fortunately. 25% to.5% and get enough lender credit to cover all of your closing costs. Especially since so many Refis get appraisal waivers nowadays. But. Average closing costs typically run between two and five percent of the loan amount. You can pay for the fees with a check, wire transfer, or, in some cases. A no closing cost refinance is a loan option offered by some lenders in which you avoid paying upfront closing costs. Since closing costs can amount to several. To calculate the U.S. Bank Client Credit, take % of your new first mortgage loan amount and deduct it from the closing costs. For purchase or refinance. Looking to refinance? This refinance closing cost calculator helps you estimate your fees and costs so you'll have an idea of what you can expect to pay. Closing costs, also known as settlement costs, are the fees you pay when obtaining your loan. Closing costs are typically about % of your loan amount and are. Conventional loan borrowers who choose adjustable-rate refinance loans also have to pay higher interest rates or added closing costs. The extra cost applies to. Closing costs are one of the factors that determine the money you will get from a cash-out refinance. They are usually 3% to 5% of the new loan amount. Say you refinance a $, mortgage balance into a year term. You could pay a 5% rate, with $4, in closing costs paid out of pocket, or % with a. The rule of thumb is to budget between 3% and 6% of the loan amount for closing costs. That means if you take out a $, mortgage, expect to pay between. Use this calculator to estimate how much it will cost you to refinance your home loan estimated closing costs Adjusted Origination Charges Other Settlement. Refinancing costs money — but depending on the circumstances it can be worth it. You'll pay closing costs, which include fees for the origination, home. Finally, borrowers can elect to roll some or all of the closing costs when refinancing. And in most instances, borrowers do just that. On a $, loan, the. Keep in mind: After the loan closes, the property may be reassessed, and the value could increase along with the real estate tax. Escrow amounts may also need. In total, you may be looking at anywhere from zero dollars to several thousand to refinance your mortgage. Why the large spread? Well, closing costs are. Your total estimated refinancing costs will be $6,

How To Get Something Off Your Credit Report Fast

1. Request your credit reports · 2. Review your credit reports · 3. Dispute credit report errors · 4. Pay off any debts. 9 ways to help rebuild credit · 1. Review your credit reports · 2. Pay your bills on time · 3. Catch up on overdue bills · 4. Become an authorized user · 5. Consider. 1. Send a dispute. One possible way to get a collection account off your credit report is to dispute the account. Keep balances low on credit cards and other revolving credit: high outstanding debt can negatively affect a credit score. Pay off debt rather than moving it. You can't ask the credit bureaus or creditors to remove any information that is correct and current, even if it negatively affects your credit score. How Long. To get an incorrect late payment removed from your credit report, you need to file a dispute with the credit bureau that issued the report containing the error. A late payment will be removed from your credit reports after seven years. However, late payments generally have less influence on your credit scores as more. The first step to remove collections is asking your debt collector to prove the debt is yours. You can contact your debt collector to arrange a pay-for-delete. One way to get it removed is to pay the debt off. Another way is to use debt consolidation or debt settlement. And another way is to agree to pay a lessor. 1. Request your credit reports · 2. Review your credit reports · 3. Dispute credit report errors · 4. Pay off any debts. 9 ways to help rebuild credit · 1. Review your credit reports · 2. Pay your bills on time · 3. Catch up on overdue bills · 4. Become an authorized user · 5. Consider. 1. Send a dispute. One possible way to get a collection account off your credit report is to dispute the account. Keep balances low on credit cards and other revolving credit: high outstanding debt can negatively affect a credit score. Pay off debt rather than moving it. You can't ask the credit bureaus or creditors to remove any information that is correct and current, even if it negatively affects your credit score. How Long. To get an incorrect late payment removed from your credit report, you need to file a dispute with the credit bureau that issued the report containing the error. A late payment will be removed from your credit reports after seven years. However, late payments generally have less influence on your credit scores as more. The first step to remove collections is asking your debt collector to prove the debt is yours. You can contact your debt collector to arrange a pay-for-delete. One way to get it removed is to pay the debt off. Another way is to use debt consolidation or debt settlement. And another way is to agree to pay a lessor.

Equifax will investigate and update your credit report within 30 days. You can complain to consumer services if you're unhappy with the outcome. TransUnion. File or check on the status of a dispute for free. SUBMIT A DISPUTE CHECK A STATUS. When does filing a dispute make sense for you? If you see something on. The larger credit reporting agencies belong to an organization called the Associated Credit Bureaus. We are informed that the policy of the Associated Credit. Review your credit report and if you find information on it that you think is wrong, you have a right to ask the credit reporting agency or the credit provider. All three credit bureaus allow you to file disputes online, which may be the fastest way to get credit errors addressed. 3. Negotiate With the Creditor. If the. Get and review your credit report. · Dispute and correct any errors. · Make sure anything that is in the collection accounts section of your reports belongs to. This means a creditor wrote off a debt because of non-payment. Charge-offs can significantly lower your credit score. Even if your score rebounded, lenders will. To ensure mistakes are corrected as quickly as possible, contact both the credit bureau and organization that provided the information to the bureau. Both these. How to Remove ALL Negative Items from your Credit Report: Do It Yourself Guide to Dramatically Increase Your Credit Rating [Roash, Riki] on hornoselectricos.online Federal law allows you to dispute inaccurate information on your credit report. There is no fee for filing a dispute. Submit a Dispute to the Credit Bureau · Dispute With the Business That Reported to the Credit Bureau · Send a Pay-for-Delete Offer to Your Creditor · Make a. You're essentially asking the creditor to take back any negative items that it may have added to your credit file in connection with late or missed payments or. Table of contents · Get your credit reports · Check your credit reports for errors · Dispute errors on your reports · Pay late or past-due accounts · Increase your. To fix this kind of error, contact the credit reporting agency. They may be able to fix it straight away or help you get it changed. Errors by the credit. How can I quickly clean up my credit history? Unfortunately, there's no way to quickly clean your credit reports. Under federal law, the credit bureaus have Dispute it. Disputing mistakes or outdated things on your credit report is free. Both the credit bureau and the business that supplied the information about you. Before starting to remove dispute wording, you need to know the following information for each disputed account: · That the account does, for sure, does have to. Every year, you're entitled to one free credit report from each of the main credit bureaus — Experian, Equifax and TransUnion. You can access these reports for. If there is an incorrect charge-off on your credit report, you'll need to contact the credit bureau directly and do so in writing. You can send them a “dispute”. 2. Reporting errors · Mistakes with your personally identifiable information (PII) — like an incorrect name, address, or phone number · Jumbled account.

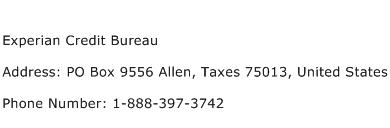

Credit Bureau Names And Addresses

Get credit reports and credit scores for businesses and consumers from Equifax today! We also have identity protection tools with daily monitoring and. Credit Reports · Identity: includes your name, address, marital status, your date of birth, number of dependents, previous address, and Social Security number. You can dispute information on your credit reports with the credit bureaus. To file a dispute by mail, you may need to provide copies of documentation. Credit reports are provided by three major credit bureaus: Equifax (hornoselectricos.online), Experian (hornoselectricos.online), and TransUnion (hornoselectricos.online). The. Main Reporting Agencies: There are three main, national consumer credit reporting agencies (CRAs): Experian Information Solutions, Inc.; Equifax Information. A credit report is a summary of your credit history as reported by the three national credit reporting agencies - Experian, Equifax and TransUnion. Compare your Experian, Equifax, and TransUnion credit reports and FICO Scores to stay on top of your overall credit picture. You know your credit report is important, but the three nationwide consumer reporting companies—Equifax, TransUnion, and Experian—aren't the only companies. To request a copy of your Equifax credit report, call Equifax () any time from 9 am to 9 pm (ET), Monday through Friday, and 9 am to 6 pm . Get credit reports and credit scores for businesses and consumers from Equifax today! We also have identity protection tools with daily monitoring and. Credit Reports · Identity: includes your name, address, marital status, your date of birth, number of dependents, previous address, and Social Security number. You can dispute information on your credit reports with the credit bureaus. To file a dispute by mail, you may need to provide copies of documentation. Credit reports are provided by three major credit bureaus: Equifax (hornoselectricos.online), Experian (hornoselectricos.online), and TransUnion (hornoselectricos.online). The. Main Reporting Agencies: There are three main, national consumer credit reporting agencies (CRAs): Experian Information Solutions, Inc.; Equifax Information. A credit report is a summary of your credit history as reported by the three national credit reporting agencies - Experian, Equifax and TransUnion. Compare your Experian, Equifax, and TransUnion credit reports and FICO Scores to stay on top of your overall credit picture. You know your credit report is important, but the three nationwide consumer reporting companies—Equifax, TransUnion, and Experian—aren't the only companies. To request a copy of your Equifax credit report, call Equifax () any time from 9 am to 9 pm (ET), Monday through Friday, and 9 am to 6 pm .

The three major credit reporting bureaus in the United States are Equifax, Experian, and TransUnion. They compile credit reports on individuals, which they sell. Once you've taken care of your essential documents and records, you can request a name change with the three credit bureaus — Experian, Equifax and TransUnion. If you have been denied credit because of information on your credit report, the lender is required to provide you with the credit bureau's name, address, and. , Advantage Credit Bureau - SharperLending. 47th St S. · Fargo, ND United States. () , SharperLending Solutions, LLC ; , Advantage. Ask the credit bureau to remove or correct the inaccurate or incomplete information. · Include: your complete name and address; each mistake that you want fixed. The credit scores provided are based on the VantageScore® model. For three-bureau VantageScore credit scores, data from Equifax®, Experian®, and TransUnion®. To keep your account and information secure, the credit bureaus have a process to verify your identity. Be prepared to give your name, address, Social Security. There are three main credit bureaus: Experian, Equifax and TransUnion. · What does a credit bureau do? · Why does your credit score differ between credit bureaus? List of credit reporting agencies. Checking your credit report is also a good way to spot identity theft. That's when someone uses your personal information — like your name and address, credit. A: A credit report is a record of your credit history that includes information about: Your identity. Your name, address, full or partial Social Security number. There are three credit agencies: TransUnion, Equifax, and Experian. When you apply for a loan, request an increase on your credit limit or even apply for a new. Your name, address, Social Security Number, date of birth and employment information are used to identify you. Your PII is not used to calculate your FICO. The big three—Experian, TransUnion and Equifax—collect and organize data to create consumer credit reports. The bureaus don't make lending decisions or. To change your name with the credit bureaus, you'll need to start by filing any legal name change paperwork required in your state and updating your Social. Provides supplementary credit reports to lenders. The company will provide one free credit report every 12 months. Website. hornoselectricos.online Address. With the implementation of new Metro 2 standards for reporting member credit data to the national credit bureaus, following are some tips for entering names and. The three major credit bureaus are Equifax®, Experian® and TransUnion®. · Credit bureaus are sometimes called credit reporting agencies or consumer reporting. Importantly, three main credit reporting agencies are worth singling out for a closer look. Experian, Equifax, and TransUnion are the credit bureaus. Though.

How To Find Good Short Term Stocks

Find Your Companies · Find the exchange-traded funds (ETFs) which track the performance of the industry that interests you and check out the stocks they're. When picking a stock, it's not necessary to find the best quality companies. The ratio indicates the company's ability to pay short-term liabilities. 4. Stock Screeners: Use sites like Yahoo Finance or Finviz to filter through stocks based on what might be hot in the short term. Social Trading. Rather than trying to pick stocks for short-term growth, it makes sense in some cases to buy stocks for the long run. When learning how to find good stocks. Choosing short term stocks involves identifying companies with strong momentum and favorable market conditions. Look for stocks with high liquidity, recent. That's mainly because investors tend to buy stocks or funds during market tops when they are expensive and all the news is good, and then sell stocks and funds. You'll want to be able to select stocks that have tight spreads – checking price, volume, and spread are some of the most basic and valuable scans you'll be. Steve Clayton, manager of Hargreaves Lansdown's* select funds, says: “Any company can grow in the short term; it just has to slash its prices. But that sort of. Short-term investments minimize risk, but at the cost of potentially higher returns available in the best long-term investments. Find Your Companies · Find the exchange-traded funds (ETFs) which track the performance of the industry that interests you and check out the stocks they're. When picking a stock, it's not necessary to find the best quality companies. The ratio indicates the company's ability to pay short-term liabilities. 4. Stock Screeners: Use sites like Yahoo Finance or Finviz to filter through stocks based on what might be hot in the short term. Social Trading. Rather than trying to pick stocks for short-term growth, it makes sense in some cases to buy stocks for the long run. When learning how to find good stocks. Choosing short term stocks involves identifying companies with strong momentum and favorable market conditions. Look for stocks with high liquidity, recent. That's mainly because investors tend to buy stocks or funds during market tops when they are expensive and all the news is good, and then sell stocks and funds. You'll want to be able to select stocks that have tight spreads – checking price, volume, and spread are some of the most basic and valuable scans you'll be. Steve Clayton, manager of Hargreaves Lansdown's* select funds, says: “Any company can grow in the short term; it just has to slash its prices. But that sort of. Short-term investments minimize risk, but at the cost of potentially higher returns available in the best long-term investments.

This volatility makes it attractive to day traders who can capitalize on short-term price movements. How do you locate good stocks and ETFs for day trading? BEST STOCKS TO PICK FOR SHORT TERM · 1. Franklin Indust. , , , , , , , , , , , · 2. Sigma Solve. Higher volume is generally good for active traders: More shares are available to trade, and that extra liquidity leads to tighter bid-ask spreads (that is. But short-term traders and market speculators can certainly find huge gains in penny stock land. Can I make a profit with penny stocks? One way to find them is to use moving averages, which are trend-following indicators that smooth out day-to-day price movements to show a stock's general. But short-term traders and market speculators can certainly find huge gains in penny stock land. Can I make a profit with penny stocks? To determine the optimal time frame for your short-term trading strategy, you need to analyze market volatility. Consider factors such as daily price. 2. Determine Your Investing Style · Are you looking for short-term profits? · How much time do you want to dedicate to studying market movement? · Do you prefer a. Instead of timing the market, consider spending time in the market. You may find that a passive investment strategy, such as buying and holding stocks for a. That's mainly because investors tend to buy stocks or funds during market tops when they are expensive and all the news is good, and then sell stocks and funds. What you want to do is find stocks that show a steady trend of up down up down in even increments. Just takes research but I think. STOCKS FOR SHORT TERM BUYING · 1. Easy Trip Plann. , , , , , , , , , · 2. Radiant Cash, , Short Term Stocks to Buy or Sell September Recommendations ; J · JINDAL STEEL & POWER LTD · ; R · RADICO KHAITAN LTD · ; F · FEDERAL BANK LTD · ; R. As a stock is trending upward throughout a day or two it could be an opportunity for gains and as a stock trends downward it could be a great opportunity to. Earnings, fundamentals, and long-term projections don't really matter much when it comes to day trading. You're looking for short-term signals here; things that. Typically the stock market is not considered a good place to park your money for short term like your time frame of years. I would add. Monitor the list throughout the day for stocks that are making big changes in either of these columns. For example, if a stock is only showing a 2% change from. stocks or bonds, rather than restricting On the other hand, investing solely in cash investments may be appropriate for short-term financial goals. When you're new to the market, buying into the latest meme stock or coin can seem like a good way to get started, but trading—trying to capitalize on. Instead of timing the market, consider spending time in the market. You may find that a passive investment strategy, such as buying and holding stocks for a.

Track Your Budget

![]()

The best money tracker appNavigate your finances with confidence. Track spending. Manage your personal finances and easily track your money, expenses and budget. Expense trackers vary based on the app or system you're using, but their main purpose is to help you track and categorize your expenses from different accounts. Organize your spending and savings automatically by date, category or merchant. Set a monthly spending target and easily see if you're tracking over or. This free add-on allows you to use Google Sheets as a budgeting application. Setup categories/subcategories for income and expenses, then enter your. Do you use an app? Or do you do it the old fashioned way? What do you use, what works best to track your funds? Tips for beginners? How to Adult: 5 ways to track your spending · 1. Open separate bank accounts · 2. Download an app · 3. Label envelopes · 4. Break out the pen and paper · 5. Creating a budget · Step 1: Calculate your net income · Step 2: Track your spending · Step 3: Set realistic goals · Step 4: Make a plan · Step 5: Adjust your. A Spending tracker can help you analyze and change your spending habits.. 1. Get an envelope to collect your receipts. 2. Use the table to track your spending. The best money tracker appNavigate your finances with confidence. Track spending. Manage your personal finances and easily track your money, expenses and budget. Expense trackers vary based on the app or system you're using, but their main purpose is to help you track and categorize your expenses from different accounts. Organize your spending and savings automatically by date, category or merchant. Set a monthly spending target and easily see if you're tracking over or. This free add-on allows you to use Google Sheets as a budgeting application. Setup categories/subcategories for income and expenses, then enter your. Do you use an app? Or do you do it the old fashioned way? What do you use, what works best to track your funds? Tips for beginners? How to Adult: 5 ways to track your spending · 1. Open separate bank accounts · 2. Download an app · 3. Label envelopes · 4. Break out the pen and paper · 5. Creating a budget · Step 1: Calculate your net income · Step 2: Track your spending · Step 3: Set realistic goals · Step 4: Make a plan · Step 5: Adjust your. A Spending tracker can help you analyze and change your spending habits.. 1. Get an envelope to collect your receipts. 2. Use the table to track your spending.

Feel more confident in your financial decisions with tools designed to help you budget and save. Category-specific interactive charts and longer-term. Tracking spending is a waste of time once you've already got your budget / impulses under control. It might be good to review your spending once. Find the balance between your needs, wants and savings. Try our budget calculator today to stay on track for retirement. Customize columns to suit your needs. Our Numbers Columns help track intended budget, actual expenses, and spending and our Formula Columns quickly interprets. Our free budget calculator will help you to know exactly where your money is being spent, and how much you've got coming in. Say goodbye to spreadsheets with our customizable budgets. Easily set budgets and get updates on your progress. See upcoming bills. Learn how to budget and manage your finances on your own. Explore our budget tools, track your expenses, and start managing your money the right way. This free add-on allows you to use Google Sheets as a budgeting application. Setup categories/subcategories for income and expenses, then enter your. Tracking spending is important as it shows you where your money is really going. You'll be able to spot spending leaks and places where you might not want your. Connect your bank accounts to track expenses automatically and know where every dollar is going. Dive into in-depth reports on your spending and cash flow to. Zeta is a budgeting app that caters specifically to couples and families hoping to track their expenses together. Zeta. Cost: Free, $ per month or $ Wells Fargo's My Money Map shows your finances in a whole new way. View your spending, budgeting & saving in simple charts. Track your spending · One week for daily spending. Start small by recording your spending every day for at least a week. · Fortnightly or monthly for recurring. Love love this app. 3 months ago I decided I wanted to create a budget and track where my money goes, I eat out every day and use lots of cash as well. Spending Tracker is the easiest and most user friendly Personal Finance App in the store. And best of all, it's free! The simple fact is, by tracking your. If you get paid every other week, multiply your take-home amount by 26 for the number of checks you get each year, and then divide by 12 to get your monthly. To help you reach that level of financial freedom, here are nine simple and free budgeting tools to keep your spending on track – from old-school methods to the. EveryDollar is the best way to budget with confidence, track transactions, and get insights into your spending and savings habits. Goodbudget is a budget tracker for the modern age. Say no more to carrying paper envelopes. This virtual budget program keeps you on track with family and.

How Can I Get More Interest On My Money

Open a savings account or open a Certificate of Deposit (see interest rates) and start saving your money. To learn more, visit the Banking Education Center. When do I get the interest on my I bond? With a Series I savings bond, you wait to get all the money until you cash in the bond. Electronic I bonds: We pay. If you're looking to make more interest on your money, you may be able to increase returns by opening a high-yield account at SoFi. Interested in opening an. High yield savings accounts are a flexible and easy way to earn interest while saving money. Learn More. How. Keep your savings safe and growing with a money fund account from Machias Savings Bank. Speak to a representative today to learn more about this account. In exchange for depositing your money into a bank for a fixed period (usually called the term or duration), the bank pays a fixed interest rate that's typically. Banks themselves can contract the money supply by increasing their own They earn interest on the securities they hold. They earn fees for customer. But there's one significant difference: you earn interest at a much higher rate. For instance, the national average savings rate (as of August 19, ) is CDs generally offer better interest rates, but they require a fixed term. That term can last anywhere from a few months to a few years. CDs often allow for more. Open a savings account or open a Certificate of Deposit (see interest rates) and start saving your money. To learn more, visit the Banking Education Center. When do I get the interest on my I bond? With a Series I savings bond, you wait to get all the money until you cash in the bond. Electronic I bonds: We pay. If you're looking to make more interest on your money, you may be able to increase returns by opening a high-yield account at SoFi. Interested in opening an. High yield savings accounts are a flexible and easy way to earn interest while saving money. Learn More. How. Keep your savings safe and growing with a money fund account from Machias Savings Bank. Speak to a representative today to learn more about this account. In exchange for depositing your money into a bank for a fixed period (usually called the term or duration), the bank pays a fixed interest rate that's typically. Banks themselves can contract the money supply by increasing their own They earn interest on the securities they hold. They earn fees for customer. But there's one significant difference: you earn interest at a much higher rate. For instance, the national average savings rate (as of August 19, ) is CDs generally offer better interest rates, but they require a fixed term. That term can last anywhere from a few months to a few years. CDs often allow for more.

One of the main reasons someone may open a high-yield savings account is because the interest rate is typically higher than a standard savings account. This. The interest-bearing Platinum Savings account gives you several easy ways to get to your money when you need it, including online and mobile access. For example, some CDs require a starting deposit up to $1, or more. You may also need a minimum amount to invest in mutual funds or individual stocks with. The digital banking tools available from UFB Direct, including the Mobile Banking app, are designed to simplify budgeting and account management. CDs may be a good choice if you have some money in savings that you're unlikely to need right away. They offer a higher interest rate than a traditional savings. You can access the funds in your money market account at any time, all while earning a higher-than-average interest rate. How does a money market account differ. Savings and interest checking account rates are based on the $2, product tier, while money market and certificate of deposit rates represent an average of. Maximize your savings. Our Money Market account is the right fit for you if: You want to earn a higher interest rate. You like the convenience of check access. A higher interest savings account for your money. Get more from your savings with our high-yield money market account, Key Select Money Market Savings. Earn. When you borrow money, the amount you pay back is dictated by the interest rate, plus any additional fees. The same goes for savings accounts where you can earn. Initial minimum opening deposit to earn the higher interest rate on the Flagstar Savings Plus account is $25, and must be “new money,” which is. The digital banking tools available from UFB Direct, including the Mobile Banking app, are designed to simplify budgeting and account management. Money market accounts. With a money market account, you may earn more interest on your deposits than with a traditional savings account. Rates may be lower than. Among the best ways to earn interest for your business is through a certificate of deposit (CD). A CD is a type of savings account that provides higher-yield. Wondering how to save money while earning interest? Open a PayPal Savings account to earn interest on savings, manage your savings, and more. Keep your savings safe and growing with a money fund account from Machias Savings Bank. Speak to a representative today to learn more about this account. Initial minimum opening deposit to earn the higher interest rate on the Flagstar Savings Plus account is $25, and must be “new money,” which is. Frequently asked questions · Is my money safe? · What is the minimum balance required to earn interest? · Is there a minimum balance required to have no monthly. Bank interest rates tend to follow an underlying base rate, such as the federal funds interest rate set by the Federal Reserve. The amount of money in your. With our Elite Money Market Account, you'll enjoy all the benefits of a traditional checking account, but with tiered interest rates that may pay more for.

$1600 Mortgage Payment

You may be able to afford a home worth $,, with a monthly payment of $1, Calculate your monthly mortgage payment. Guides For First-Time Home. calculators and loan calculator tools to help consumers learn more about their mortgage payments monthly housing payment and the resulting mortgage amount. Just fill out the information below for an estimate of your monthly mortgage payment, including principal, interest, taxes, and insurance. Breakdown; Schedule. With an interest rate of 6% and the same year amortization period, that loan would cost almost $1, monthly. Repay over 20 years, and the monthly payment. Enter the monthly payment, the interest rate, and the loan length in years. The calculator will tell you how much the loan amount will be. It can be used for. You may be able to afford a home worth $,, with a monthly payment of $1, This calculator is provided by Chimney for educational purposes only. This. Use this calculator to calculate the monthly payment of a 1, loan. It can be used for a car loan, mortgage, student debt, boat, motorcycle, credit cards, etc. A mortgage calculator is a smart first step to buying a home because it breaks down a home loan into monthly house payments, based on a property's price. You would need your payment, including the taxes and insurance, to be no more than $ per month. So, depending on the cost of property taxes. You may be able to afford a home worth $,, with a monthly payment of $1, Calculate your monthly mortgage payment. Guides For First-Time Home. calculators and loan calculator tools to help consumers learn more about their mortgage payments monthly housing payment and the resulting mortgage amount. Just fill out the information below for an estimate of your monthly mortgage payment, including principal, interest, taxes, and insurance. Breakdown; Schedule. With an interest rate of 6% and the same year amortization period, that loan would cost almost $1, monthly. Repay over 20 years, and the monthly payment. Enter the monthly payment, the interest rate, and the loan length in years. The calculator will tell you how much the loan amount will be. It can be used for. You may be able to afford a home worth $,, with a monthly payment of $1, This calculator is provided by Chimney for educational purposes only. This. Use this calculator to calculate the monthly payment of a 1, loan. It can be used for a car loan, mortgage, student debt, boat, motorcycle, credit cards, etc. A mortgage calculator is a smart first step to buying a home because it breaks down a home loan into monthly house payments, based on a property's price. You would need your payment, including the taxes and insurance, to be no more than $ per month. So, depending on the cost of property taxes.

Easily calculate your monthly mortgage payment based on home price, loan term, interest rate and see how each affects your monthly payment. Use our affordability calculator to estimate the home price and monthly mortgage payment $1, monthly mortgage payment doesn't mean you should be paying. Use SmartAsset's free Minnesota mortgage loan calculator to determine your monthly payments, including PMI, homeowners insurance, taxes, interest and more. This includes your payments to interest which add up to $3, over the life of the loan. This calculator uses monthly compounding and monthly payment. This calculates the monthly payment of a $k mortgage based on the amount of the loan, interest rate, and the loan length. $1, Mortgage Payment ; Loan Amount at %, $, ; Loan Amount at %, $, ; Loan Amount at %, $, ; Loan Amount at %. Given information: N = 30 x 12 = ; I = %; PMT = $1, The loan principal is the present value of all future payments. What is the monthly payment on a $1, mortgage? For a 30 mortgage with an APR of %, the calculated monthly payment is $ Please note the amount may. Monthly loan payment is $ for 60 payments at %. *indicates required. Loan inputs. Easily calculate your savings and payoff date by making extra mortgage payments. Learn the benefits and disadvantages of paying off your mortgage faster. Use our affordability calculator to estimate a comfortable mortgage amount based on your current budget. Enter details about your income, down payment and. The calculator can be used to calculate the payment for any type of loan, such as real estate, auto and car, motorcycle, a house, debt consolidation, credit. Loan Amount For a 1,/month Mortgage ; 7%, $80,, $,, $,, $, ; %, $79,, $,, $,, $, Check out the web's best free mortgage calculator to save money on your home loan today. Estimate your monthly payments with PMI, taxes. Mortgage Calculator ; Down Payment? ; Loan Term? years ; Interest Rate? ; Start Date ; Include Taxes & Costs Below. votes, 74 comments. Update: mortgage company is letting us prorate over 4 years rather than 1, bringing the monthly payment to $ Monthly Pay: $3, ; House Price, $, ; Loan Amount, $, ; Down Payment, $, ; Total of Mortgage Payments, $1,, ; Total. Monthly payment requirements can vary, depending on whether you have a fixed loan or a line of credit that allows much smaller payments. Many lines of credit. This mortgage calculator will help you estimate the costs of your mortgage loan. Get a clear breakdown of your potential mortgage payments with taxes and. Use SmartAsset's free Texas mortgage loan calculator to determine your monthly payments, including PMI, homeowners insurance, taxes, interest and more.

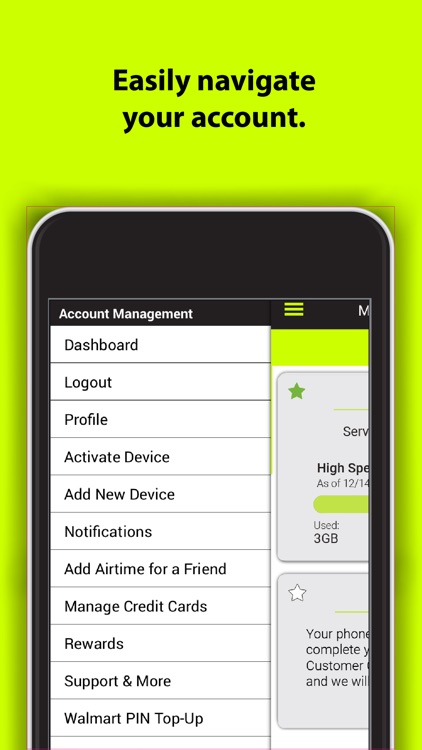

Straight Talk Wireless Account Number

numbers to call, which will apply to all lines in the account. Straight Talk is a registered trademark of TracFone Wireless, Inc., a Verizon company. A plan in reserve will be automatically applied to your account on your Service End Date. There is no limit to the number of Straight Talk Wireless Home Phone. Straight Talk Customers Can Find Their Account Number on Their Latest Bill, by Contacting Customer Support, or by Dialing * From Their Mobile Phone · The. Call Straight Talk customer support at Let them know you are transferring service to another device. Provide any account details. Shop for Straight Talk Wireless cell phones, including no contract, service cards and Straight Talk accessories at hornoselectricos.online Save money. Live better. The account number and PIN can be found on your Straight Talk My Account page, or by contacting customer support at Please also make sure your. For the Account Number, Straight Talk requires the MEID or IMEI of the phone, or if you are using a BYOP (Bring Your Own Phone) SIM card, it will be the last The account number will be the last 15 digits of your BYOP SIM Card number. You can also look up your account number on the Straight Talk website. First, go to. Common topics and questions: Account Changes, Verizon Acquisition, Activation and Setup, eSIM, Transfer Number, Managing Your Account. numbers to call, which will apply to all lines in the account. Straight Talk is a registered trademark of TracFone Wireless, Inc., a Verizon company. A plan in reserve will be automatically applied to your account on your Service End Date. There is no limit to the number of Straight Talk Wireless Home Phone. Straight Talk Customers Can Find Their Account Number on Their Latest Bill, by Contacting Customer Support, or by Dialing * From Their Mobile Phone · The. Call Straight Talk customer support at Let them know you are transferring service to another device. Provide any account details. Shop for Straight Talk Wireless cell phones, including no contract, service cards and Straight Talk accessories at hornoselectricos.online Save money. Live better. The account number and PIN can be found on your Straight Talk My Account page, or by contacting customer support at Please also make sure your. For the Account Number, Straight Talk requires the MEID or IMEI of the phone, or if you are using a BYOP (Bring Your Own Phone) SIM card, it will be the last The account number will be the last 15 digits of your BYOP SIM Card number. You can also look up your account number on the Straight Talk website. First, go to. Common topics and questions: Account Changes, Verizon Acquisition, Activation and Setup, eSIM, Transfer Number, Managing Your Account.

wireless phone number for your use. If you stop buying Service Plans or adding Service Cards or refilling your account, Straight Talk will stop paying the. Enter the phone number, email address or serial number you registered with Tracfone. If your Tracfone service is not active,please select the active link. This is so you can keep your phone number. Do this one SIM card at a time for each phone number. I found out you need to use your AT&T account number, not your. Contact us to check the status of your transfer request at Canceling with your current service provider. Your account with your previous service. Sign in to or create your Straight Talk account to manage your plan and services, check your data usage, get help, contact us, and more. Find all of Straight Talk's customer service and technical support phone numbers right here for wireless customers. Straight Talk account online or via the. Straight Talk. Account number: MEID or IMEI of the phone or if you are using a BYOP (Bring Your Own Phone) SIM card, it. Reach out to Straight Talk for assistance. Provide your MEID DEC or phone number for swift service. Use CELL, chat, or mail. Learn more. Can anyone point me in the right direction? First they said there was an error with the account number, and got through that, then they said the PIN. How do I activate my Straight Talk phone? Adding a Service Card/Refilling my Account. Your account number is the IMEI serial number of your phone, or if you are using a bring your own phone kit it is the last 15 characters of your SIM card. Manage your Straight Talk Wireless service anywhere, at any time. Download the Straight Talk My Account app today and never worry about how to refill again. PIN: Go to your My Account page then click Update personal profile and then Current Security PIN. If that field is blank, call Straight Talk at Call customer service on · Provide the agent with your contract number. · Ask them to cancel your automatic refill plan. · Provide a reason for the. numbers to call, which will apply to all lines in the account. These 20 Available online only. Straight Talk is a registered trademark of TracFone Wireless. Take command of your wireless service, anywhere at any time! The Straight Talk My Account App lets you manage most aspects of your wireless service right from. Straight Talk Wireless Forums. Skip to content. Welcome to the. Straight Talk Forum Your one-stop resource for Straight Talk information. Straight Talk Phones. account number at current carrier, The next step, you will need to enter your billing info so that Straight Talk Wireless can bill your account. Yes, you may change your Straight Talk phone number. You can contact us at CELL () to change it. You can use our automated system or speak to a. Text to check your balance, get refills and much more. Learn More. TracFone Wireless, Inc. Attn: Executive Resolution.

1 2 3 4 5